So, what is meant by a credit score of a person? How will it affect your financial future, including the interest rates you will be receiving from the lenders? This article will discuss everything you need to know about credit scores and how you can improve your credit score to qualify for lower interest rates.

What is a credit score?

A credit score is a numerical expression mainly based on credit reports. This indicates the extent to which a person is considered suitable to receive financial credit and their probability of paying the money back on time.

Lenders use credit scores to gauge the potential risk created by lending to consumers. It acts as a vital role in a lender’s decision to offer you credit. They use this credit score to determine if you are qualified to receive a loan, your interest rate, credit limits, and the terms they will offer. Having a high credit score can benefit you by making it easier for you to receive a loan.

The credit score is calculated using the information in your credit reports such as payment history, outstanding balances, length of credit history, and applications for new credit accounts, and types of credit accounts. It is essential to know yours credit score to know where your credit stands and whether you need to improve your credit score. Knowing your credit score before applying for a loan or any credit is very important because your credit score significantly impacts approval decisions.

The factors that affect your credit score

- Payments history for loans and credit cards

- Credit utilization rate

- Total debt

- Public records – a bankruptcy

- New credit accounts you have recently opened.

- Type, number, and age of credit accounts

- Number of inquires for your credit report.

We will try to explain this in two examples below.

Example 1

Your friend needs money and comes to you for some financial help. You lend him $500, and you come to an agreement that he will pay $50 minimum every month to pay you back. He keeps his promise and pays you $50 every month and repays $500 in 10 months. After a couple of months, he again needs $500. Will you lend him? Yes, you will lend him because his repayment history is good, and you know he will return it.

Example 2

Your friend needs money and comes to you for some financial help. You lend him $500, and you come to an agreement that he will pay $50 minimum every month to pay you back. He repays you the first month, and then he suddenly stops paying. You are calling him every day to discuss this, but he is not taking this seriously. After a couple of months, he again needs $500. Will you lend him? Of course not. If you lend him, you will keep collateral this time or any other security to make sure if he does not pay, you can sell the collateral and cover your loss.

Lending institutions work similarly. You usually get money from them in the form of mortgages, loans, secured and unsecured lines, credit cards, etc. If you do not pay or are late on your payments, your credit score will drop, and financial institutions will take you as a high-risk customer. At this point, your interest rate will go up. People who have good credit scores and good repayment history get lower rates because financial institutions do not consider them as a risk.

Some other examples where your interest rate can go up is when you apply for a loan, and your debt ratio is high. Wondering what the debt ratio is? Let us retake an example.

We will assume your income is $4000 a month. And following are every month’s expenses.

Mortgage $1700

Utilities $450

Groceries $600

Credit Card Payments $500

Student Loan $500

House/Personal Insurance $200

Total $3950

You have applied for a car loan. Your monthly payment is $600. After looking at the scenario above, financial institutions will either decline the loan, or your interest rate will be higher because the money you are making does not support the repayments. Your debt ratio is higher. Your expenses after having a car will be higher than what you are making now!

How your credit score impacts your interest rates

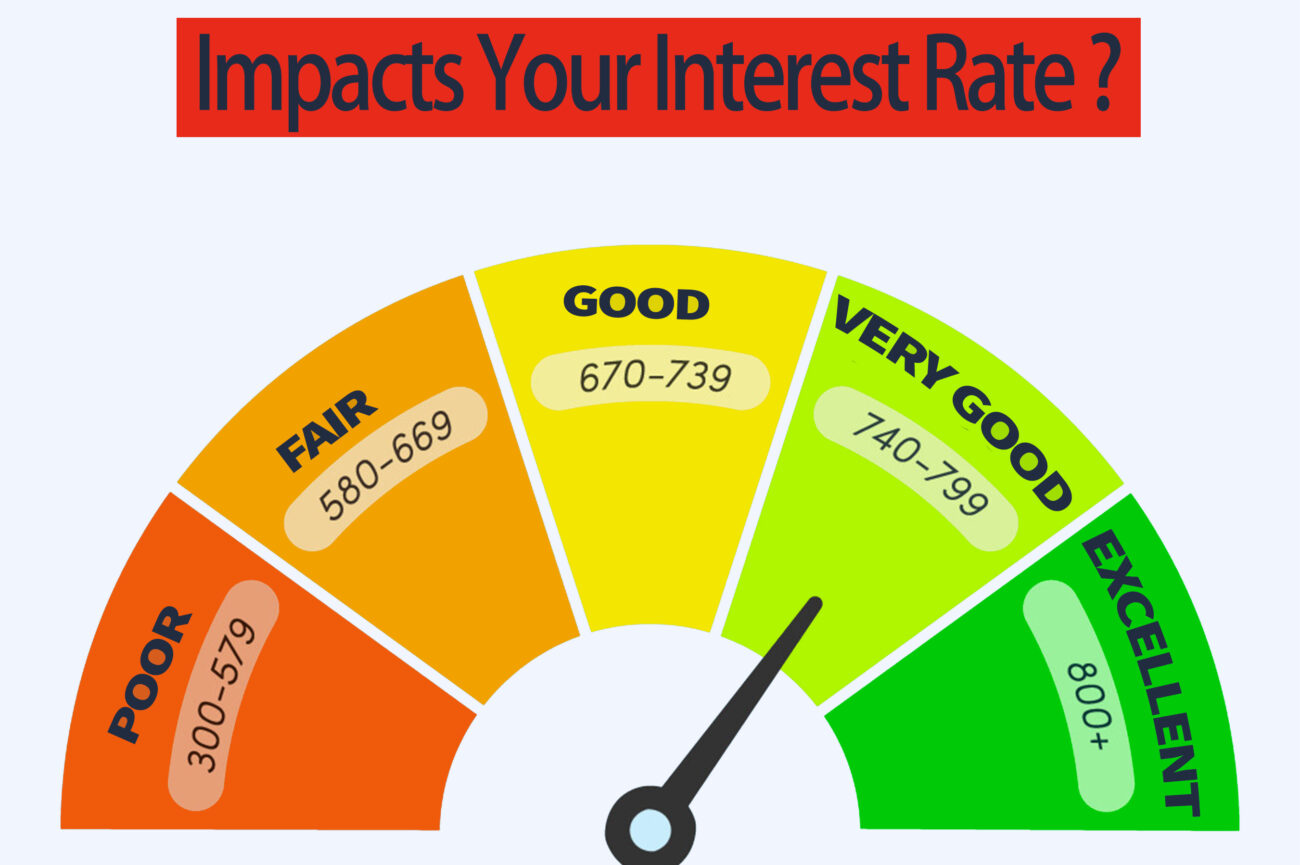

Credit scores typically range from 300-850. Credits scores from 580-669 are considered fair, 670-739 are considered a good score, 740-799 as a perfect score, and above 800 are considered an excellent credit score. Lenders and creditors see you as a lower-risk borrower if your credit score is more than 670.

If you have a lower credit score, it can result in difficulties when qualifying for a loan. Besides the interest rates that lenders offer, your loan term can change.

When you have a good credit score, the possibility of qualifying for lower interest rates under favorable terms and conditions is higher.

How you can improve your credit score

The most crucial step to maintain and improve your credit score is to have a very close eye on upcoming bills. Suppose you are facing financial challenges; it is recommended to make minimum payment at least. Making minimum payment indicates to the lender that everything is on track; you need some time to repay the loan. By any chance, if you know that you will fail to make a payment, let the lender know before time so that they can make some arrangements according to your situation.

Using and paying for a credit card is an excellent way to improve your score. If financial institutions have denied a credit card, ask for a secure credit card. This is another way of building your credit.

Final thoughts

If you have a poor credit score, you will have to take the necessary steps to make it a better one. You can take actions such as paying bills on time, making payments of utility and cell phone on time, paying off debt and keeping your balance low on credit cards, opening new credit accounts only as needed, keeping your unused credit cards open, and reporting incorrect information on your credit reports. If you are having issues getting a car loan, CLICK HERE to get help.